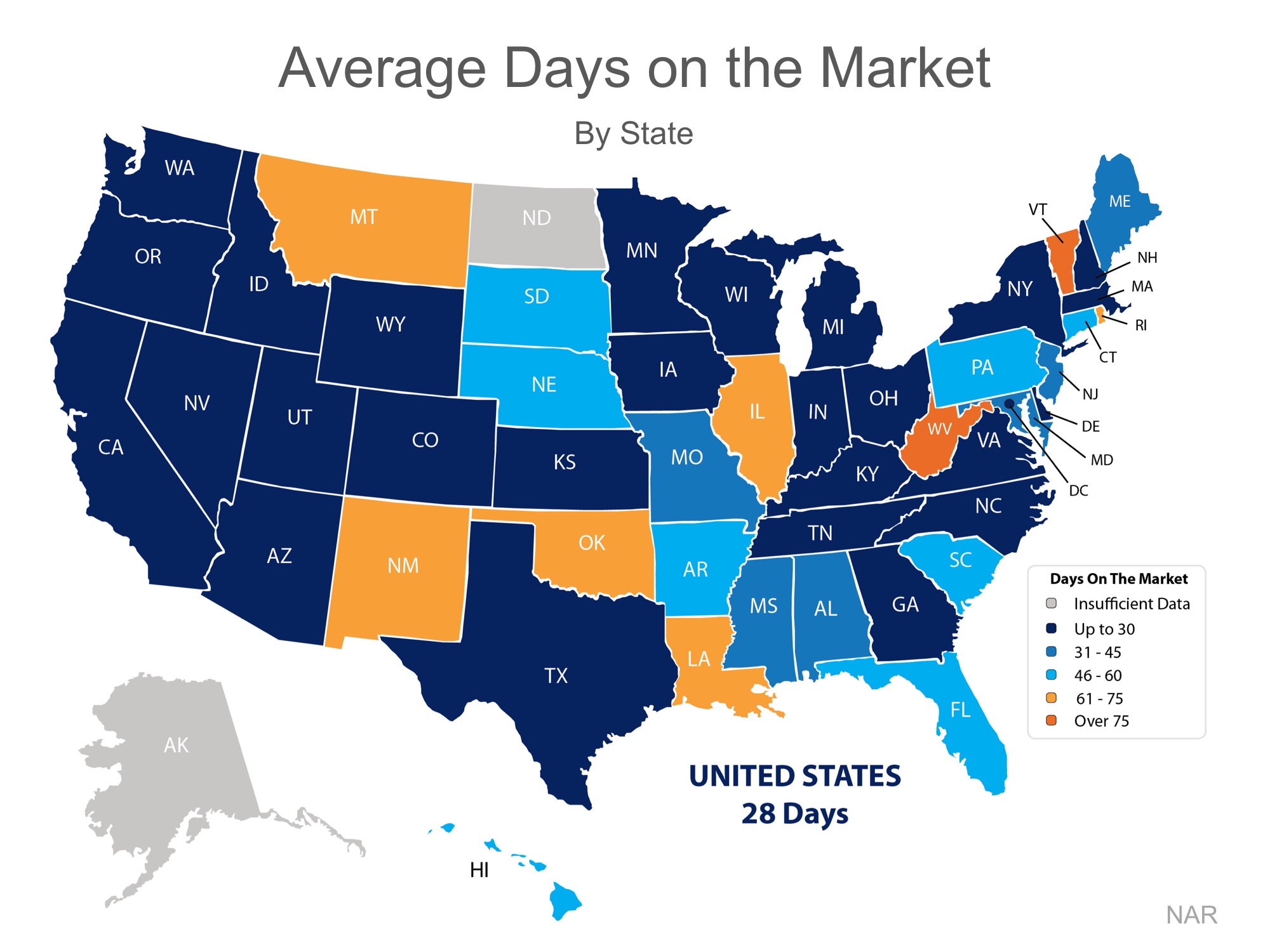

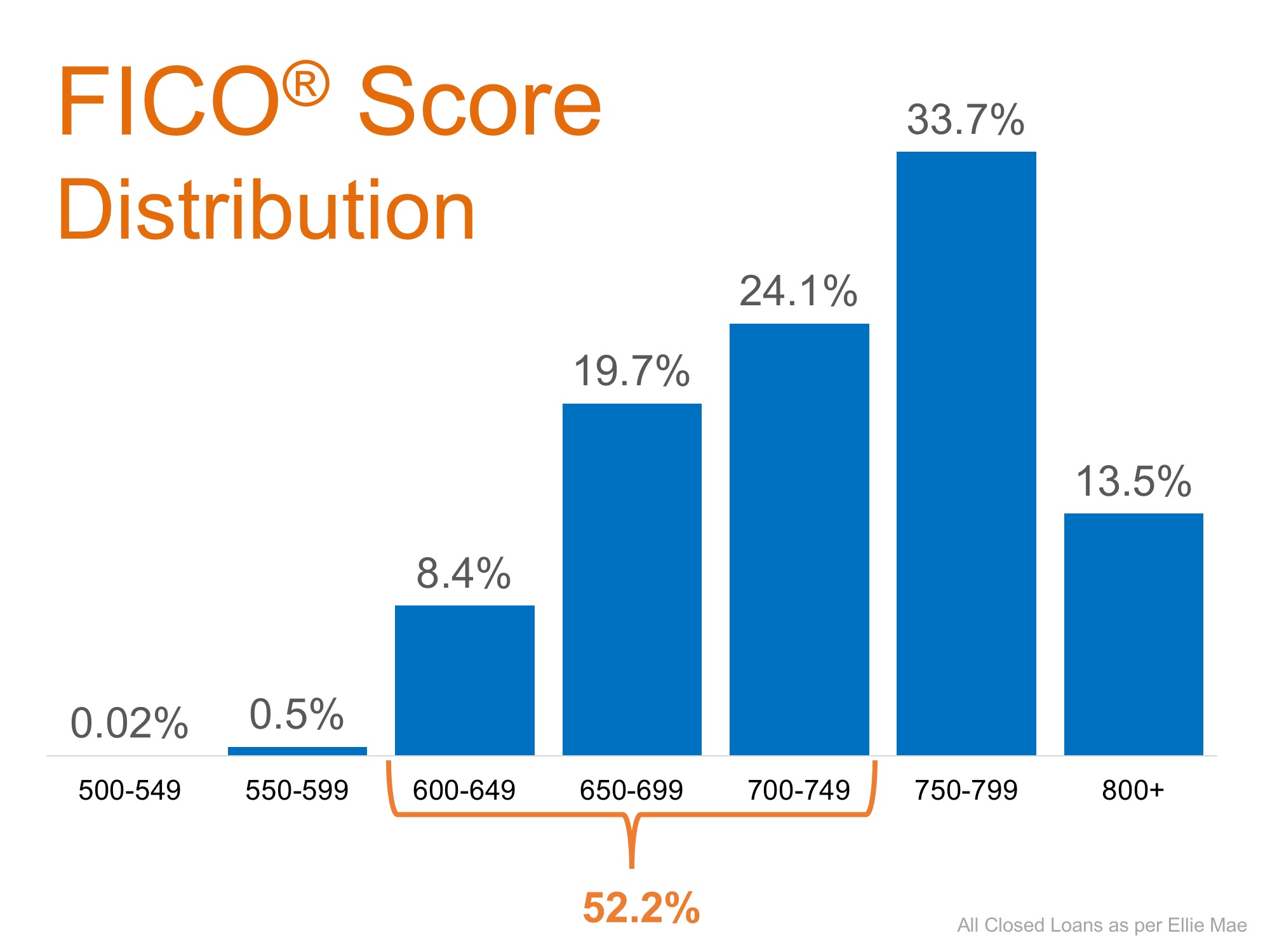

"What happened to all the homes? I hear this question a great deal from buyers shopping for a home. This article from REALTOR® Magazine gives some insight. The fear of finding a new home to fit changing lifestyles before selling is a factor here in Fort Worth, Keller, Watauga, North Richland Hills, Roanoke and Saginaw. My advice if you're thinking of selling your home and buying another is 1. Have your home READY to list. Do your market research for a realistic price, consult an agent and have the home ready to sell. If your home is in good condition now, have the listing photos taken and have your agent prepared to activate the listing on a moment's notice. 2. Investigate "bridge loan" opportunities that would allow you to buy a home and THEN market yours. It will remove the need for a "contingent on sale: clauses that can make your offer to buy the house less attractive and give you flexibility to have your existing home in ideal condition by by moving out then completing minor upgrades like painting rooms or doing minor upgrades to get the best price. 2. Find your new home and get it under contract. (If you did step 2 and have your bridge financing in place, GREAT! Now you can close and move even before the next step.) 3. Put your home on the market at a fair market price and have a plan from your agent for marketing the first days it's on the market. In short inventory situations, you have your BEST opportunity in the first days it' on the market. Your objective is to get the maximum exposure for the house and let buyers compete for the home.

Contact me and I will do a free Comparative Market Analysis so you know what similar homes have sold for in your neighborhood and advise you on the best way to maximize your sale return and the most efficient way to find your new home.

2 Major Reasons Why Inventory Is So Low

DAILY REAL ESTATE NEWS | FRIDAY, AUGUST 11, 2017

Inventory of available homes on the market is the lowest it’s been in two decades, but the reasons may surprise you. Two of the likely culprits are baby boomers and homeowners who are simply satisfied with their home, according to realtor.com®’s

Housing Shortage Study.

Baby boomers are showing a desire to age in place in their current homes, and their refusal to sell is creating a clog in the market, according to the study. Eighty-five percent of baby boomers surveyed say they are not planning to sell their home in the next year. That means 33 million properties—many of which are urban condos or suburban single-family homes—will stay off the market. Many of those properties would be popular choices for millennials, a generation still largely waiting in the wings to break into homeownership.

“Boomers, indeed, hold the key to those homes the market desperately needs, both in the urban condo and the detached suburban home segment,” says realtor.com® chief economist Danielle Hale. “But with a strong economy and rising home prices, there’s really no reason for established homeowners to sell in the short term. Although downsizing might be on the minds of boomers, they face the same inventory shortages and price increases plaguing millennials.”

Furthermore, 63 percent of respondents to the survey indicate that their current home meets the needs of their family. They cite low interest rates (16 percent), recently purchasing their home (15 percent), and needing to make home improvements and low property taxes (each at 13 percent) as reasons not to sell. “Life events drive real estate transactions,” Hale says. “When the majority of homeowners feel their family’s needs are being met by their current home, there is nothing compelling to them to put their home on the market.”

There may be hope that more starter homes will hit the market soon. Possibly offsetting the low supply of starter homes, which is down 17 percent year over year, 60 percent of respondents to realtor.com®’s survey who did say they plan to sell in the next year are millennials who want to move to a larger home or one with nicer features.

“The housing shortage forced many first-time home buyers to consider smaller homes and condos as a way to literally get their foot in the door,” says Hale. “Our survey data reveals that we may see more of these homes hitting the market in the next year, but whether these owners actually list will depend on whether they can find another home.”

![What State Gives You the Most ‘Bang for Your Buck’? [INFOGRAPHIC]](https://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/04155449/STM-Share-150x150.jpg)

![Home Prices Up 6.64% Across the Country! [INFOGRAPHIC] | Simplifying The Market](https://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/24140007/FHFA-Home-Prices-STM.jpg)

![To Stage…or Not to Stage? That Is the Question! [INFOGRAPHIC]](https://d39ah2zlibpm3g.cloudfront.net/wp-content/uploads/2017/08/17121457/20180818-Share-STM-150x150.jpg)